The reporting suite in Salesforce.com is sort of like the $100 tool kit you get at Home Depot. It has all the standard stuff (screwdrivers, sockets, wrenches, pliers in a stylish red box of some kind), and if you know what you’re doing it will work for most everything, and for more advanced stuff you could make it work, although if you are a pro you’ll want more power tools.

As part of a webinar I did with Salesforce we started to discuss one of the big problems with campaign measurement – the fact that your data is only as relevant as the number of closed deals you have. I had done a presentation on this a few years back and had some requests for it and found that it was the classic “Consultant’s Powerpoint” – lots of pictures, and useless unless you know the story.

So here’s the story. In a perfect world you’d measure how many closed deals came from your campaigns, have a simple dashboard showing the dollars generated and go home a hero. In reality, odds are you’re going to start tracking and measuring, right to the point of reallocating budget prior to the first deals closing – a classic “Fire, Aim, Fire.”

The first thing to confirm is that you are getting a primary campaign source for every opportunity. This is one of the more recent adds to marketing tracking and it’s the closest thing you’ll get to a silver bullet. Doing an initial pass and confirming that every opportunity has a primary campaign (even if it’s “Unknown”) allows you to run some interesting reports and start to get a picture of where the deals and inbound leads are coming from. For most cleanup like this I’ve found that the Salesforce Excel Connector is your cordless electric drill – a killer power tool. It’s kind of a hassle to set up, between finding a copy of Excel 97 and learning how the macros work, it takes some elbow grease, but it pays for itself quickly – imagine being able to find all opportunities from the past month, be able to match them to all the contacts and leads from a specific company and update these fields in Excel directly rather than pulling them up in SF or having to use the bulk loader. I’m also a bit surprised there’s nothing better out there, if you know of anything else like it, please share.

Now that you have an idea of what programs are working here are some common factors to examine:

- Any specific type of program better than others (Webinars vs. Whitepapers, Live Events)

- Region and/or Account Manager – this can get into management of the sales team

- If PPC is productive

- Does training drive adoption and increase retention?

- Isolate and report on telemarketing or other lead qualification

One topic that would require a post of its own (or maybe even a whole book, which might be the most boring book ever) is what to do with deals that close from multiple campaigns. Campaign weighting is not trivial (saying the white paper is 20% responsible for the win, 80% of it goes to the demo). Although it gets complicated quickly there are two reasons to do it: one is to try multivariable testing – do any combinations of campaigns do considerably better than others? The other is to give your reporting credibility. By default most reports that show a closed deal that went through multiple campaigns will assign all the dollars to each campaign. In other words, a $40,000 deal that went through 4 campaigns makes it look like your 4 programs generated $160,000 in sales. These kind of reports are just the kind of thing the CEO is looking for so you can take his place picking up trash in an orange jumpsuit when the tax auditors come calling.

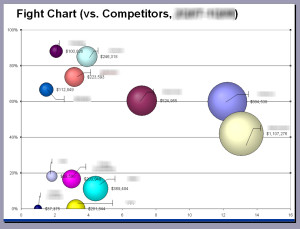

Depending on your market you’ll probably also want to add fields at the opportunity level to track both competitors, and incumbents. It’s very common to find that you will be more effective against certain competitors. You may also find that certain incumbents may indicate that you’ll never get budget for the project. I’ve found a bubble chart like the one in this post can give you an interesting view of your forecast, showing both aging, percentage to close, and competitors.

Another area that requires a lot of planning is both lead status and campaign member status. You’ll want anything showing movement in the funnel as lead status, anything showing progression through a program as campaign member status and these have to be mapped. You may have to do some automation to have the lead status updated as campaign status changes. These also make great triggers for marketing automation efforts…

For more complicated graphs you can go across multiple objects (contacts and opportunities for example), which limits some of your graphing options if you were to use Excel, but I’ve always found that being able to schedule reports and show them in dashboards is the only real route to adoption. People only get into the excel graphs when the quarterly board of directors meeting is coming together, which may be all you need it for.

If you’ve run any interesting reports or have found other tools you like, please share, there are a lot of new solutions as this space is evolving quickly.